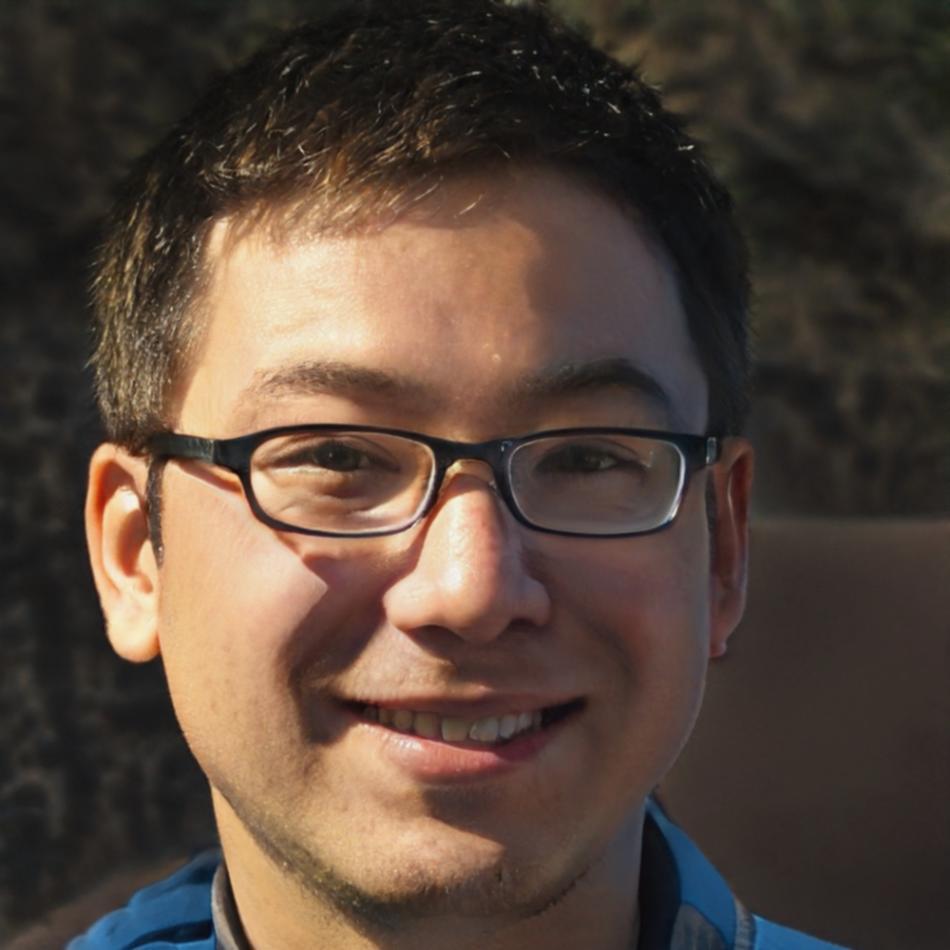

Freya Magnusson

Small Business Owner

Started in August 2022 because her café was

profitable on paper but she couldn't explain

where money went. Within four months, she'd

identified unnecessary supplier costs and

built a simple tracking system. By mid-2024,

she'd opened a second location and actually

understood her cash flow patterns. Still uses

the spreadsheet templates from the course.

22 months after completion

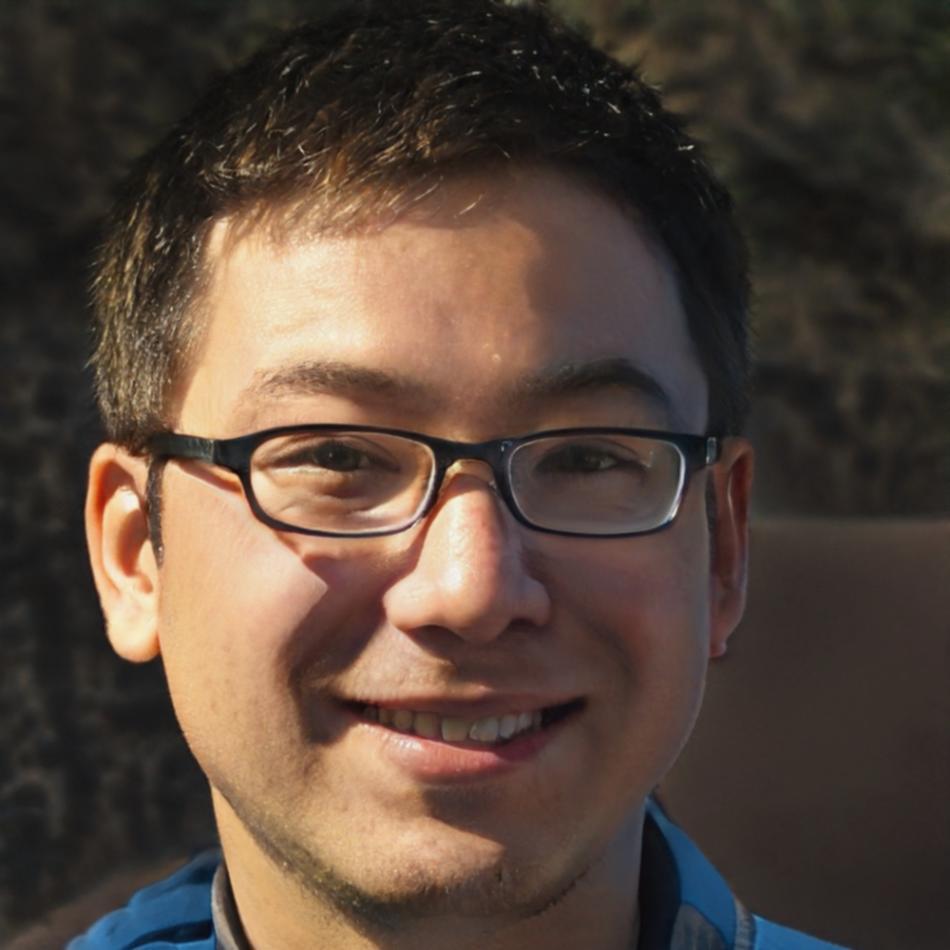

Lachlan Drummond

Freelance Consultant

Joined in February 2023 after three years of

chaotic invoicing and last-minute tax stress.

The program helped him separate personal and

business finances properly for the first

time. By September 2024, he'd built enough

financial clarity to take on two additional

contractors. Says the biggest shift was

learning to forecast quarterly instead of

monthly.

18 months after completion